how much does colorado tax paychecks

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Or See Exactly How Much You Paid For Each Category With Your Personal Tax Receipt Here Https Www Nationalpriorities Org Interactive D Tax Day Tax Income Tax

Residents who live in Aurora Denver Glendale Greenwood Village or Sheridan however - must also pay local taxes called an Occupational Privilege Tax.

. The income tax is a flat rate of 455. - Colorado State UI or SUTASUI is a of all wages up to an annual wage limit of 1260000 per. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Colorado residents.

The 500 gross figure is used here because personal exemptions do not exist for the tax year 2019. Colorado Salary Paycheck Calculator. 2022 Federal State Payroll Tax Rates for Employers.

2022 Federal State Payroll Tax Rates for Employers. Your employees get to sit this one out so dont withhold FUTA from their paychecks. As an employer youre paying 6 of the first 7000 of each employees taxable income.

No personal information is collected. Colorado Paycheck Quick Facts. There is no income limit on Medicare taxes.

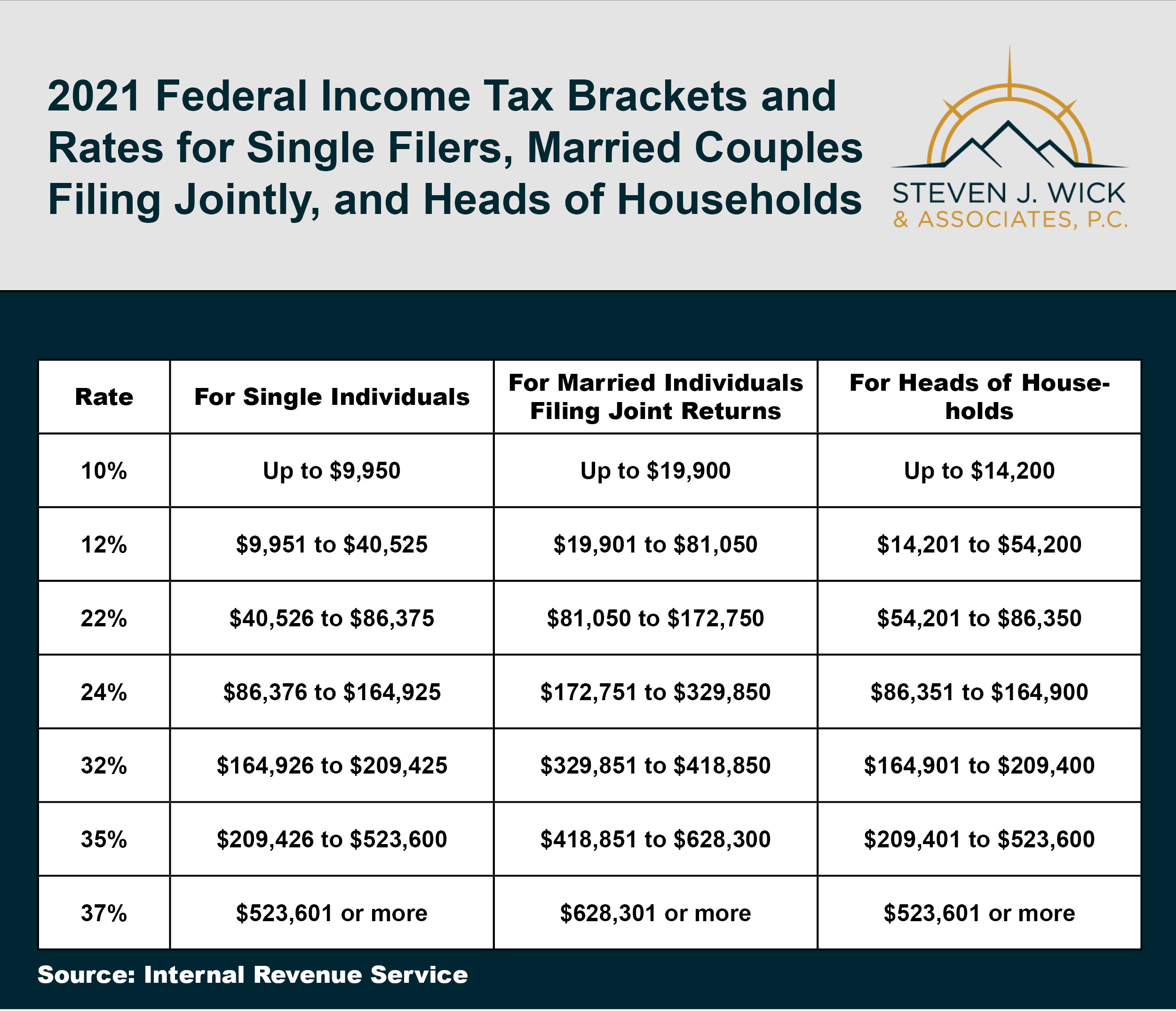

The Colorado income tax has one tax bracket with a maximum marginal income tax of 463 as of 2022. After a few seconds you will be provided with a full breakdown of the tax you are paying. Colorado income tax rate.

The state income tax in Colorado is assessed at a flat rate of 463 which means that everyone in Colorado pays that same rate regardless of their income level. Why Gusto Payroll and more Payroll. Employers You must withhold Colorado income tax from any compensation paid to any employee if.

Why Gusto Payroll and more Payroll. Employers are required to file returns and remit tax on a quarterly monthly or weekly basis depending on the employers total annual Colorado wage withholding liability. After a few seconds you will be provided with a full breakdown of the tax you are paying.

One of the new laws HB-1311 will eliminate certain state tax deductions for individuals and households with higher. Whose tax payments may increase. - Matching SocialSecurityOASDI is 62 until one has reached the wages limit of 128400 - Matching Medicare is 145 of all wages.

No standard deductions and exemptions. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis. Helpful Paycheck Calculator Info.

Colorado tax year starts from July 01 the year before to June 30 the current year. Colorado Hourly Paycheck Calculator. Some states like Colorado set a lower percentage limit for how much.

So the tax year 2021 will start from July 01 2020 to June 30 2021. To use our Colorado Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Withholding Tax Filing Requirements Department of Revenue - Taxation Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for vaccine information.

So the tax year 2021 will start from July 01 2020 to June 30 2021. - Fed UI or FUTAFUI is 06 of all wages up to 700000 limit paid per employee per calendar year. Both employers and employees are responsible for payroll taxes.

That 463 applies to Colorado taxable income which is equal to federal taxable income. Do you make more than 400000 per year. No state-level payroll tax.

Payroll benefits and everything else. Census Bureau Number of cities that have local income taxes. Switch to Colorado hourly calculator.

The good news is that If you pay your state unemployment taxes in full and on time each quarter you can claim a tax credit of up to 54. Colorado income tax rate. Colorado has a straightforward flat income tax rate of 455 as of 2021.

Automatic deductions and filings direct deposits W-2s and 1099s. How Employer Taxes are calculated. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by.

Detailed Colorado state income tax rates and brackets are available on this page. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s. Solution The tax rate on wages paid to all filers when using the annual withholding formula for the State of Colorado has changed from 463 percent to 455 percent.

If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes. How Much Is Payroll Tax In Colorado. The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding.

Gusto offers fully integrated online HR services. Up to 25 cash back The garnishment amount is limited to 25 of your disposable earnings for that week whats left after mandatory deductions or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage whichever is less. There is no income limit on Medicare taxes.

No state-level payroll tax. Every employer must prepare a W-2 for. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

Colorado Salary Paycheck Calculator. 145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145. There are eight other states with a flat income tax.

Colorado has a straightforward flat income tax rate of 455 as of 2021.

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Simple Strategies To Save Your Business Money Small Business Sarah Business Money Best Small Business Ideas Promote Small Business

Colorado Paycheck Calculator Adp

Fort Collins Tax Preparation Services Planning By A Local Trusted Cpa

Tax Documents And Deadlines University Of Colorado

Colorado Paycheck Calculator Adp

Plan A Christmas Vacation Math Project And For Use With Google Classroom Math Projects Christmas Math Activities Math Activities Elementary

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Free Tax Prep Checklist Packet Mom For All Seasons Tax Prep Tax Prep Checklist Homeschool Freebies

Micr Encoding Font Digital Graphics Labs Fontspace Micr Font Money Template Digital Graphics

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Colorado Paycheck Calculator Smartasset

Government Revenue Taxes Are The Price We Pay For Government